June NFP beats consensus on the back of education and health services employment, while private NFP surprises downside. With S&P Global monthly GDP flat over the last six months through May, many key indicators followed by the NBER Business Cycle Dating Committee (BCDC) are flat or falling (although NBER places primary emphasis on employment, which is still rising, along with personal income).

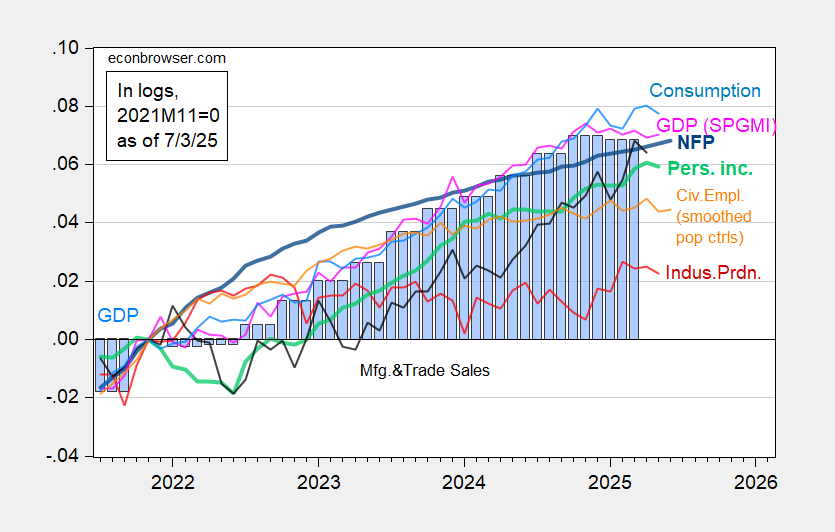

Figure 1: Nonfarm Payroll incl benchmark revision employment from CES (bold blue), civilian employment using smoothed population controls (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. 2025Q1 GDP is third release. Source: BLS via FRED, Federal Reserve, BEA, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (7/2/2025 release), and author’s calculations.

Here’s a picture of some alternative indicators.

Figure 2: Preliminary Nonfarm Payroll early benchmark (NFP) (bold blue), civilian employment adjusted to NFP concept, with smoothed population controls (orange), manufacturing production (red), real retail sales (black), and coincident index in Ch.2017$ (pink), GDO (blue bars), all log normalized to 2021M11=0. Source: Philadelphia Fed [1], Philadelphia Fed [2]Federal Reserve via FRED, BEA 2025Q1 third release, and author’s calculations.

In general, I put much heavier weight on the CES vs. CPS measures of employment. However, if you’re a believer that the CPS series signals recessions earlier than the CES, well, keep on worrying (there’s actually only mixed evidence in support of this view, using real-time data, see this post).

Note that all these data are backward looking, with employment referring to roughly second week in June. Weekly indicators of economic activity confirm a slowdown starting in April, continuing through the later part of June.

Figure 3: Lewis, Mertens, Stock Weekly Economic Index (blue), and Baumeister, Leiva-Leon, Sims Weekly Economic Conditions Index for US plus 2% trend (tan), all y/y growth rate in %. Source: Dallas Fed via FRED, WECIaccessed 7/3/2025.