Bank of Finland’s BOFIT concludes:

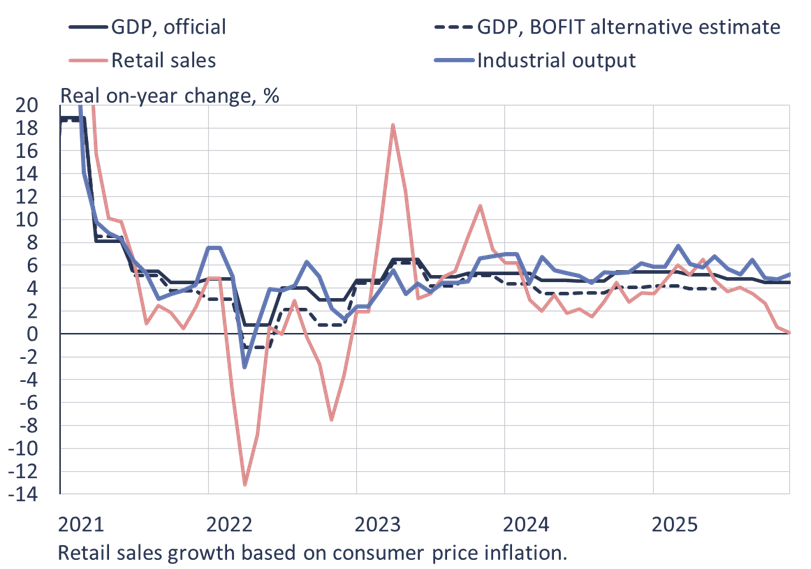

China’s National Bureau of Statistics (NBS) reports fourth-quarter growth of the Chinese economy slowed to 4.5 % y-o-y. Third-quarter GDP growth last year was still 4.8 % and first-half growth exceeded 5 %. The NBS data also indicate that consumption demand accounted for 2.4 percentage points of 4Q GDP growth, while net exports contributed 1.4 percentage points and investment demand 0.7 percentage point. GDP growth for all of 2025 (5.0 %) unremarkably matched the official “about 5 %” target announced at the National People’s Congress last spring.

BOFIT’s alternative GDP calculation suggests that economic growth for all of 2025 was roughly 1 percentage point below the official figure. The alternative GDP growth estimate for the fourth quarter was 3.3 %. Industrial output growth accelerated slightly in December from previous months to over 5 % y-o-y. For all of 2025, industrial output rose by roughly 6 % y-o-y. Foreign trade, which is closely linked to industrial output, remained strong throughout the year. Net exports clearly supported economic growth for the entire year.

Source: BOFIT, 23 January 2026.

Rhodium Group estimates are less sanguine about growth:

China’s statistics show real GDP growth of 5.2% year to date through the third quarter of 2025, an acceleration from 2024. They will almost certainly claim 5% growth or better for the full year. A year ago, we said China could perform better in 2025hitting 3 to 4.5% if Beijing prioritized growth after a poor 2024 performance in the mid-2s. But actual 2025 growth fell short of 3% again, with a strong first half and then a badly down-sloping second half.

Here’s Rhodium Group’s (December 22, 2025) assessment:

Source: Rosen et al. (2025).

One can’t directly compare the NBS results to Rhodium Group’s as the NBS measure is Q3 YTD, and the latter’s is full year. However, it’s clear that Q4 growth would have to be very fast in order to hit the overall 5%.

The authors trace the divergence between reported and actual to the collapse of the residential housing sector, beginning in 2021. In my view, this implies that while Chinese misstatement of growth might have been present before 2021, overstatement has been the case since then.

The Fernald-Hsu-Spiegel (2020) China Cyclical Activity Tracker — which provides estimates of deviations from trend — does suggest an official overstatement relative to actual in 2022 (while partner-country imports suggest an overstatement in 2025Q1):

Source: SF Fed CCATaccessed 2/5/2026.

Assuming the trade figures are being reported more accurately than domestic ones (who knows? lot’s of things are now considered state secrets and reporting on them is considered espionage), this means that domestic final demand is desperately faltering, and Chinese economic growth is incredibly dependent on exports, at exactly the time when protectionist pressures are increasing Europe and the rest of East Asia.

A side note: This fog of data uncertainty, which pervades both private and public sector policymaking, is the natural consequence of political forces forcing the statistical agencies to propagate a given view of the economy. We should be on-guard for further attempts to distort or suppress data in the USlest we become China-like in this respect.