From Townhall today:

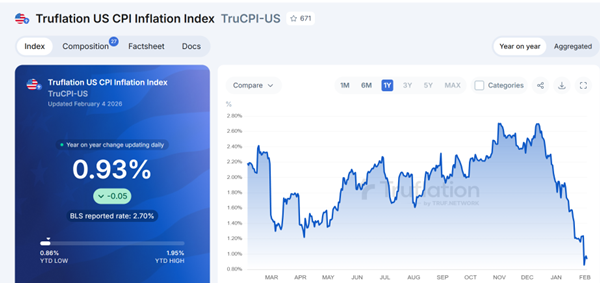

As of today, y/y CPI inflation is 0.93%!

Source: Truflationaccessed 2/4/2026 3pm CT.

For comparison, a month ago, the inflation rate was 1.95% y/y; hence we achieved a percentage point disinflation in a month! Two months ago, the Truflation rate was 2.48%, so that inflation has come down around a percentage point and a half over that time period.

EJ Antoni (also Chief Economist of Heritage) explains the numerical difference between Truflation inflation and CPI measured inflation thusly:

…CPI assigns housing about one-third of its weight, whereas Truflation is closer to one in four.

That makes everything else weigh more in Truflation. So if gasoline or eggs are coming down, as they are now, it’s a bigger deflation in Truflation.

But the kicker here is it’s actually housing that’s coming down now, along with rents. Even the slight easing of interest rates since over the last several months has brought more supply to the market, pushing down prices…

OK, we have encountered Dr. Antoni’s “magic asterisk” housing deflators elsewhere (in that case, he argued GDP had been in decline from 2022 to 2024). But, let’s compare BLS CPI-headline, CPI-ex shelter, and Truflation y/y measures.

Figure 1: Year-on-Year headline CPI inflation (bold blue), CPI ex-shelter (red), Truflation inflation (green). Truflation measures are at mid-month. CPI-headline January 2026 observation is Cleveland Fed nowcast of 2/4/2026. Source: BLS, Truflation, Cleveland Fed, and author’s calculations.

We can see how much the treatment of housing costs affects the CPI, in part, by including the CPI-ex shelter index. I’m willing to believe that Truflation might provide additional insights, but I’m dubious about overall dropping as rapidly as Truflation indicates in January. If indeed they are dropping as fast as Truflation suggests, I say “think imminent recession”.

I’m all for the use of big data, but I like the documentation to be complete (e.g., Cavallo et al.vs. the two-pager Truflation provides*) I wouldn’t give too much credence to an inflation measure that exhibits such wide swings day-to-day as Truflation. But that’s just me.

* Why does the table in the documentation refer to ONS? Seems a little sloppy to me.