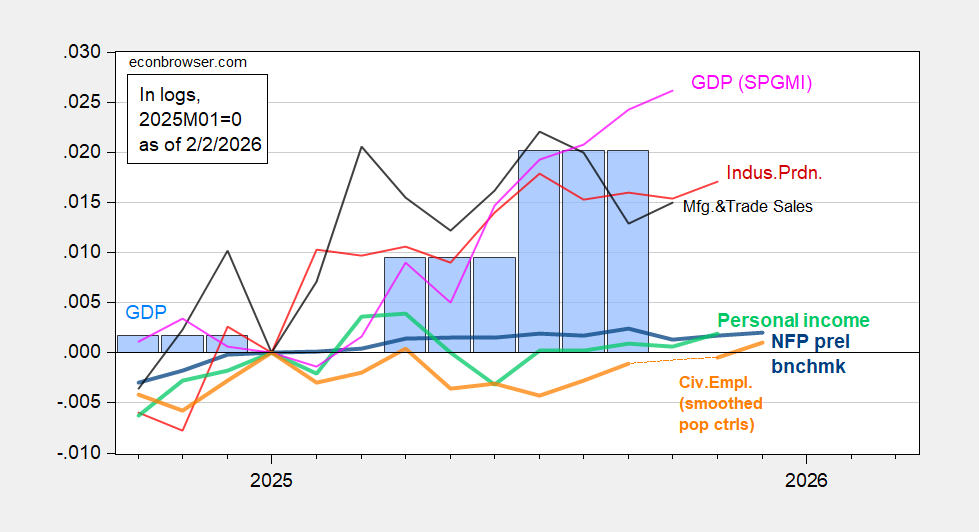

Due to the Federal government shutdown, the employment release is going to be delayed. Here are NBER business cycle indicators, including the latest monthly GDP, that we have now:

Figure 1: Implied NFP preliminary benchmark revision (bold blue), civilian employment with smoothed population controls (bold orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold light green), manufacturing and trade sales in Ch.2017$ (black), and monthly GDP in Ch.2017$ (pink),GDP (blue bars), all log normalized to 2025M01=0. Source: BLS, ADP, via FRED, Federal Reserve, BEA 2025Q3 updated release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (2/2/2026 release), and author’s calculations.

Output measures are rising smartly, or remain above January levels. However, the key measures followed by the NBER — personal income and employment — all remain mired at near January levels.

Here are some alternative indicators:

Figure 2: Implied Nonfarm Payroll early benchmark (NFP) (bold blue), civilian employment adjusted to NFP concept, smoothed population controls (bold orange), manufacturing production (red), consumption (light blue), real retail sales (black), freight services index (brown), and coincident index (pink), GDO (blue bars), all log normalized to 2025M01=0. Source: Philadelphia Fed [1], Philadelphia Fed [2]Federal Reserve, BTS via FRED, BEA 2025Q3 updated release, and author’s calculations.

Once again, employment series remain flattish through December even as GDO is up, and consumer spending rises through November. November consumption is 2.5% above January levels. (Bloomberg consensus for ADP private NFP in January is only +48K.)

In other words, the dichotomy between aggregate indicators and the labor market measures remains, in both sets of indicators.