Responses to DoJ probe: An event study.

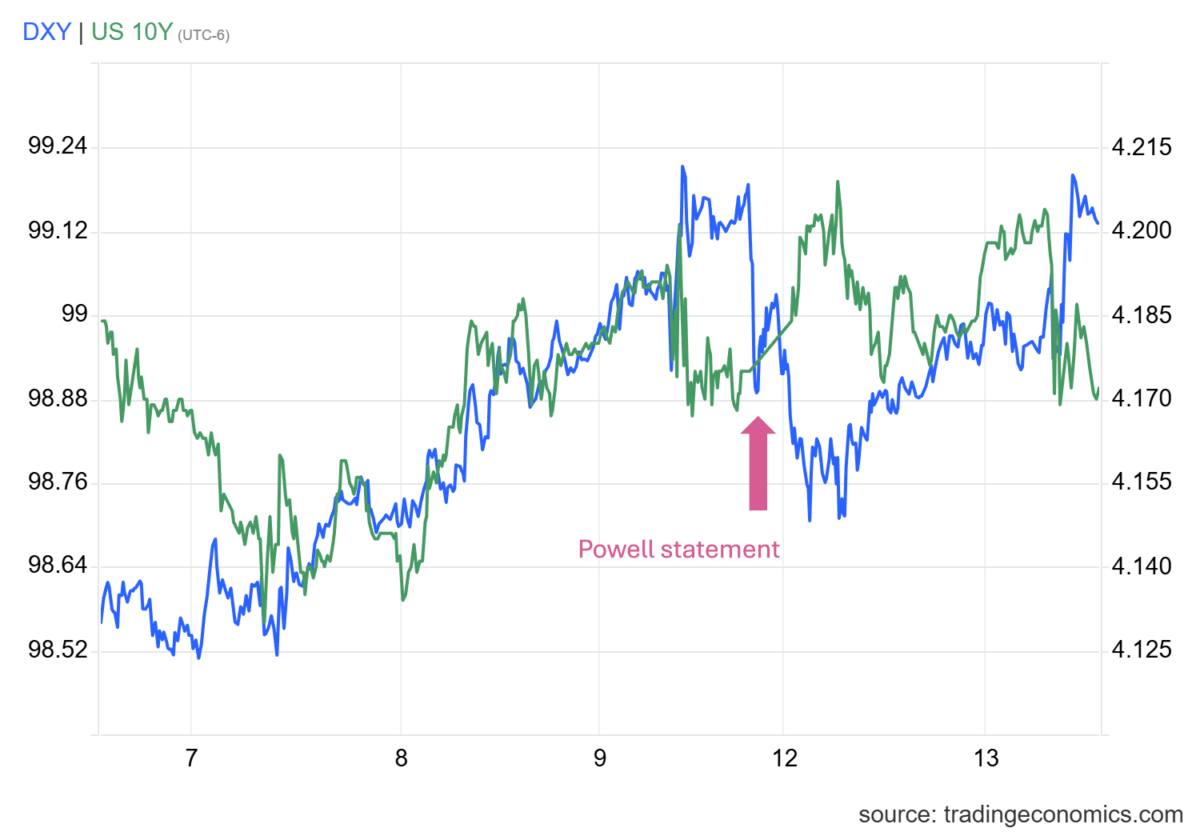

Source: TradingEconomics, accessed 1/13 1pm CT.

The ten year yield rose in response, while the dollar fell in value. Both of these are consistent with a view that damaging Fed independency would reduce central bank credibility (a la Barro-Gordon).

Source: Kalshi, accessed 1/13/2026 1pm CT.

Some of the recovery in yields is probably due to the market betting on TACO-Fed edition.

The Kalshi probability of a premature ouster of Chair Powell rose from 8% to 16.5% and now back to about 8%, as pushback from a few Republican senators and the bond market induced a slight White House pullback. Odds on whether Powell will still be a governor as of August 2026 fell from 84% to 60%.

Addendum, 2pm CT:

The gold market appears less convinced that the Administration will retreat:

Source: TradingEconomics, accessed 1/13/2026, 2pm CT.