A staple of mid-1980’s investment modeling, q-theory was an alternative to the Keynes’ marginal efficiency of capital or Jorgenson user cost of capital approaches. A version of q –the ratio of market value to replacement value of a corporation’s capital — was central in Summers’ 1981 BPEA paper modeling corporate investment behavior. And yet, q-theory is now almost completely absent from recent discussion of the level of capital investment (in contrast to the debate nearly two decades ago). Why? First a picture of q, the market price relative to replacement cost of physical capital.

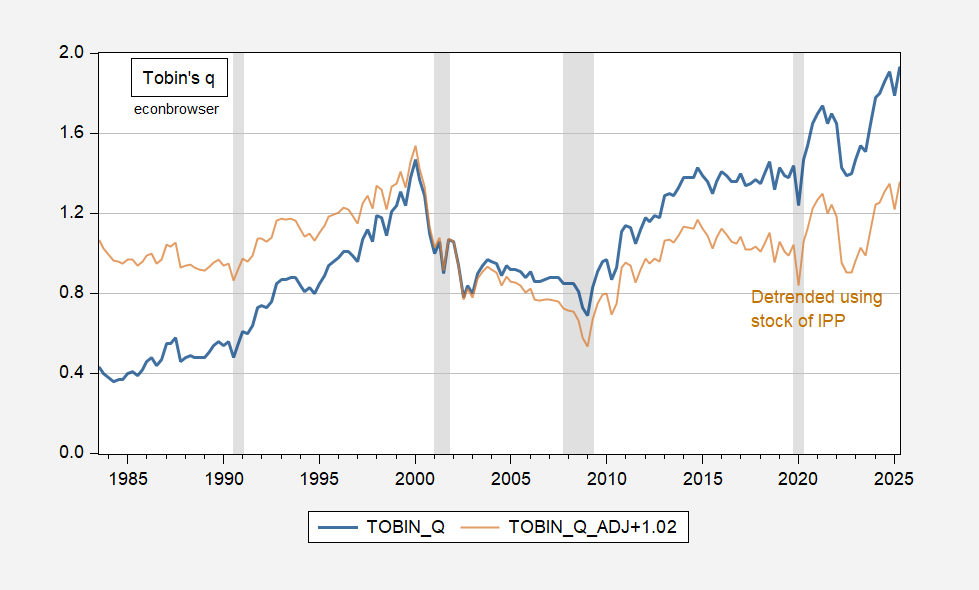

Figure 1: Tobin’s q (blue), and detrended Tobin’s q (tan) for the nonfinancial corporate sector. Detrended q calculated by regressing Tobin’s q on stock of intellectual property products, linearly interpolated from annual data. NBER defined peak-to-trough recession dates shaded gray. Source: Fed Flow of Funds via FRED, BEA, NBER, and author’s calculations.

Tobin’s q is closing in on 2 in 2025Q2, while it only reached about 1.5 at the peak of the dot.com boom.

Chirinko (JEL1993) reviews the various models of investment, and of q, notes that average q (which can in principal be calculated) equals marginal q (which is unobservable) if (1) markets are perfectly competitive, (2) production and adjustment cost technologies are linearly homogeneous, (3) capital is perfectly homogeneous, and (4) investment decisions are largely separate from other real and financial decisions.

Needless to say, in an era of AI and some capital is intangible, average q is likely to be mismeasured, and even more unlikely to be representative of marginal q. Assuming the degree of mismeasurement of average q is due to intangibles which can be proxied by intellectual property products (IPP), R&D and software (BEA [1] [2]), then one obtains the measure shown as the brown line in Figure 1. (It should be noted that the rate at which intangibles depreciate is unclear, depending on innovation and excludability (Crouzet et al.2022)so the net impact on the intangibles capital stock is unclear; also IPP does not include “organizational capital” etc.)

In 2025Q2, detrended q is then lower than it was in 2000Q1 (1.35 vs. 1.54). I’d like to say this means the market’s valuation of the capital stock is not excessively high, but in actuality detrending using log stock of IPP is pretty close to linear (deterministic) detrending, and this is a dangerous thing to do when q looks like an I(1) process (one can’t reject the null hypothesis of unit root).

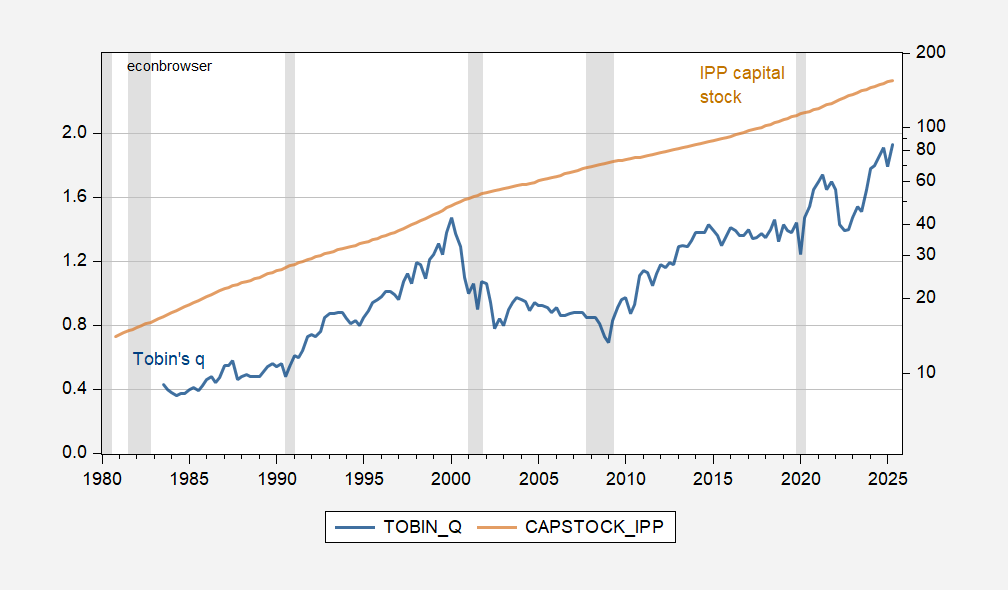

Figure 2: Tobin’s q (blue, left scale), and log stock of intellectual property products (tan, log right scale) for the nonfinancial corporate sector, linearly interpolated from annual data. NBER defined peak-to-trough recession dates shaded gray. Source: Fed Flow of Funds via FRED, BEA, NBER, and author’s calculations.

So, we are forced to look elsewhere for insights into what the level of investment should be (forward P/E’s or CAPE maybe).