In the FT today:

The dollar’s dominance was built on the foundation of America’s many strengths. But like termites eating away at a house’s woodwork, Trump’s dysfunctional policies are eating away at its support and rendering the US currency acutely vulnerable to future shocks.

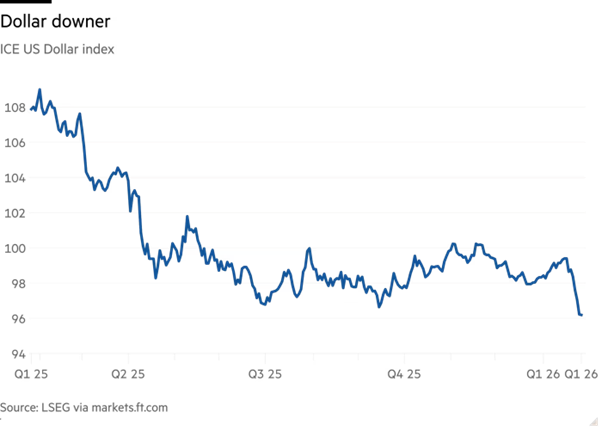

This remarkable newfound weakness was on full display this week, after President Donald Trump reality-divorced insistence that “the dollar is doing great”. Traders responded by sending it even lower:

Kamin and Sobel identify where the termites are gnawing away:

— The status of the US as a trusted ally and partner has eroded further, weakening a key pillar of the dollar’s global stature. …

— The soundness of US macro policy has come into question. …

— Mounting budget deficits and debt threaten the future solvency of the federal government and the safety and liquidity of US Treasuries. …

— The rule of law is being weakened. Global investors may not be concerned by ICE’s behaviour or the weaponisation of the Department of Justice by the While House. But the administration’s intrusions into private business — as well as the taxes on capital flows that nearly made it into the OBBB — should lead them to hesitate before committing long-term investments into the US.

I think that the stunning drop in the dollar is consistent with a loss of credibility driven by the termites progress, as discussed here.

More from Steve Kamin on the dollar during and post-“Liberation Day” here.