Today we are fortunate to present a guest post written by N. Kundan Kishor (University of Wisconsin-Milwaukee).

The Divergence Between Rent Measures

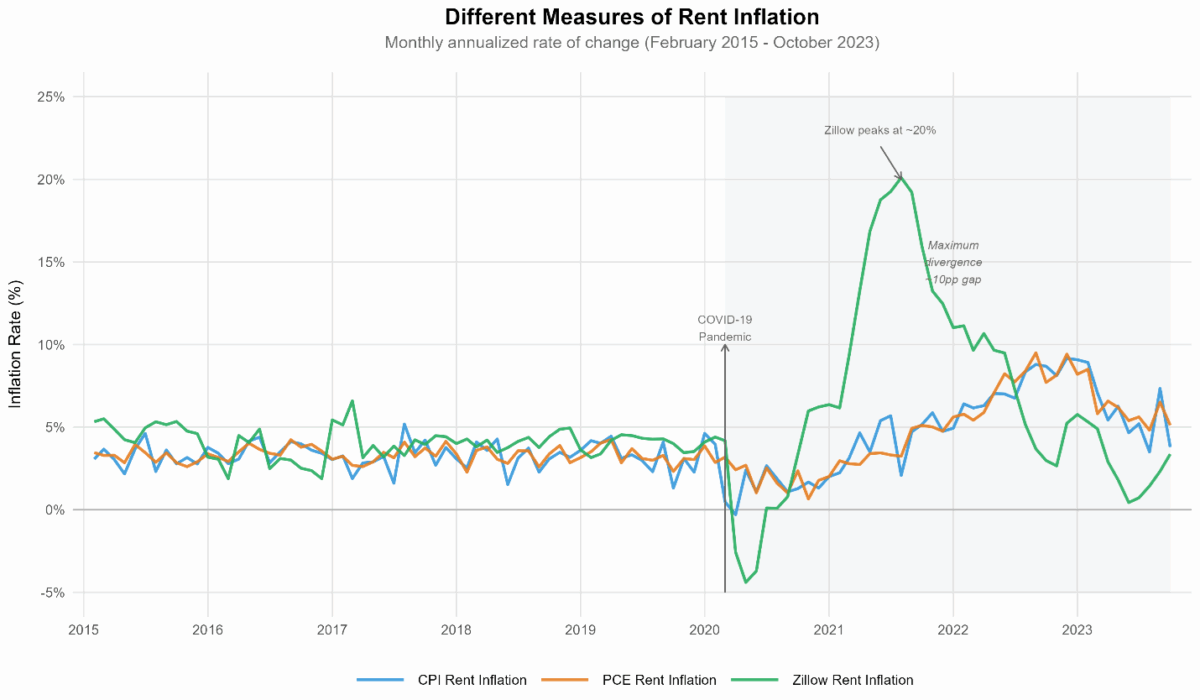

During the COVID-19 pandemic, a significant gap emerged between different measures of rent inflation. While the Zillow Observed Rent Index (ZORI) showed annualized inflation rates of approximately 15% in early 2022, the official Consumer Price Index (CPI) for rent remained at 5.5%. This divergence prompted research into whether alternative data from Zillow could effectively predict official rent inflation measures.

My research examines this question using data from February 2015 to October 2023, revealing both the promise and limitations of using private sector rent data for economic forecasting. My results show that ZORI’s effectiveness in forecasting is highly dependent on the forecast horizon and prevailing market conditions.

Understanding the Different Rent Measures

Figure 1: The three rent measures show strong divergence during 2021-2022, with Zillow rent inflation spiking to 20% while CPI rent remained below 10%.

The data reveals striking behavioral differences between rent measures. While CPI and PCE rent inflation move closely together (correlation of 0.91), Zillow rent inflation exhibits much lower correlations with official measures (0.25 with CPI, 0.15 with PCE).

These differences stem from fundamental methodological distinctions:

- CPI Rent: The Bureau of Labor Statistics (BLS) measures rent changes for all tenants, with new leases naturally comprising only about 20% of the sample reflecting actual market turnover where most renters are in continuing leases at any given time. This approach captures what American households pay each month, not hypothetical market prices. The advantages are clear: it provides stability, accurately represents household expenses, and filters out market noise. However, this methodology creates an inherent lag of 12-18 months in detecting market turning points, as changes only flow through gradually as leases roll over.

- Daily (dawn): Focuses exclusively on new-tenants asking prices using a repeat-rent methodology, capturing real-time market conditions. While this results in higher volatility, it provides potentially valuable forward-looking signals about where the broader rental market is heading.

Out-of-Sample Forecasting Performance

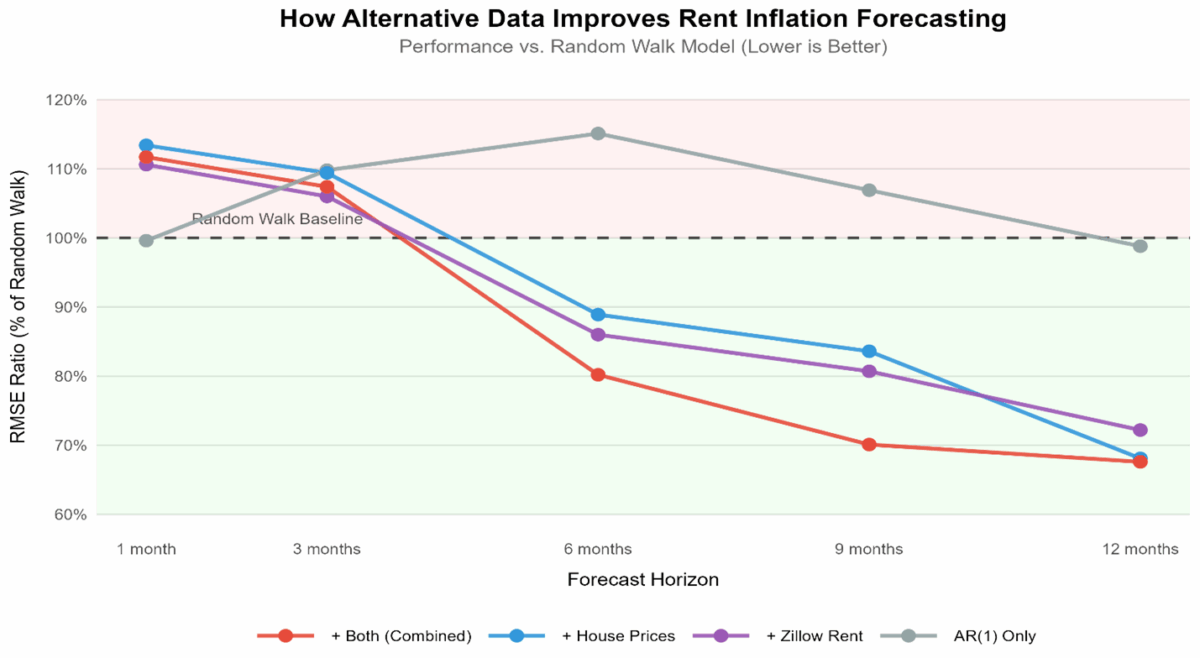

When I assessed whether Zillow data could predict future CPI rent inflation using out-of-sample forecasts from 2018 to 2023, I discovered significant horizon-dependent patterns. The graph below shows how different forecasting models perform compared to a simple random walk baseline (where values below 100% indicate better performance).

Figure 2: Forecast accuracy improves at longer horizons when incorporating Zillow data or both Zillow and house prices, with best performance at 12-month horizons. RMSE ratios below 1.0 indicate better performance than random walk.

When evaluated for out-of-sample forecasting, models incorporating Zillow data demonstrated horizon-dependent accuracy. All models struggle to beat a simple random walk at short horizons. Adding Zillow data or house prices makes predictions slightly worse. This suggests that monthly rent changes are inherently noisy and difficult to predict.

At medium horizon (6-months) the basic AR(1) model performs poorly (15% worse than random walk), but models incorporating Zillow data or house prices suddenly show their value, improving accuracy by 14-20%. The predictive power of alternative data becomes significant at longer horizons. At a 12-month forecast horizon, including Zillow rent data improves accuracy by nearly 30%. The best-performing model, which combines both Zillow data and house prices, achieves a 32% improvement in accuracy over the random walk baseline. This suggests Zillow data acts as a powerful leading indicator for rent inflation 6 to 12 months in the future.

The Pandemic-Driven Structural Break

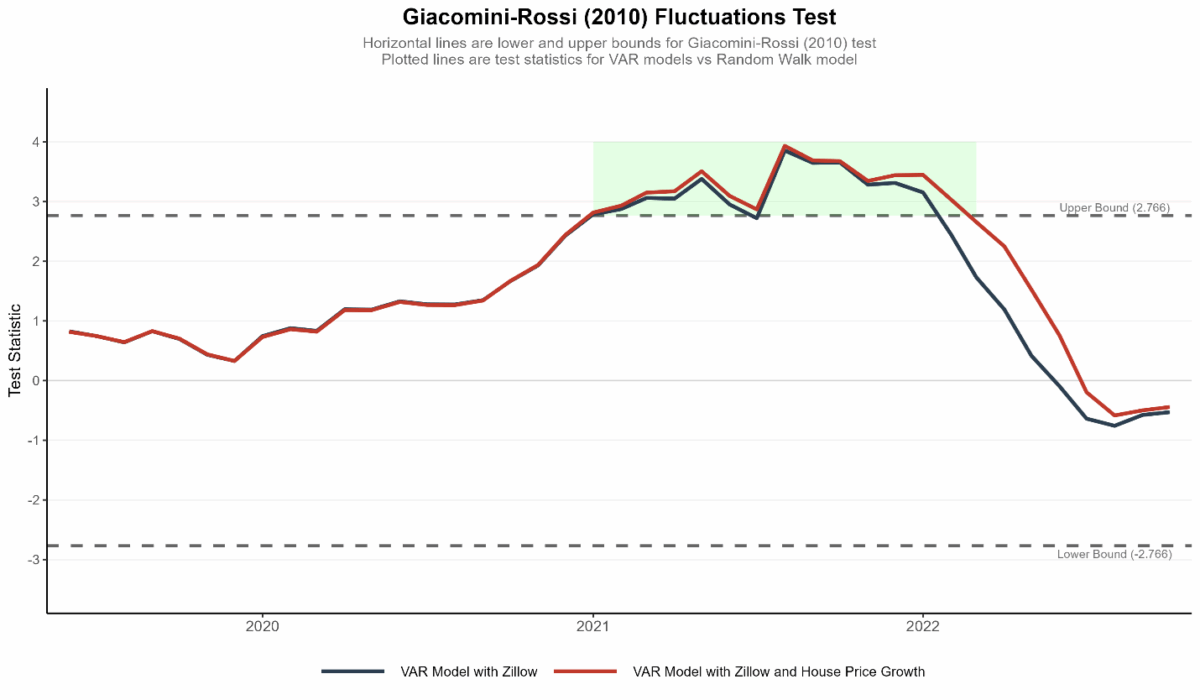

The most compelling finding emerges from my forecast stability analysis using the Giacomini-Rossi fluctuations test for 1-12 month forecast horizon as shown below.

Figure 3: The Giacomini-Rossi test statistic exceeds critical bounds (horizontal lines) starting June 2020, indicating statistically significant forecast improvements over a random walk model from including Zillow data during the pandemic period.

Before June 2020, models with Zillow data showed no statistically significant advantage. However, starting in mid-2020, these models suddenly began outperforming traditional approaches-precisely when Zillow and CPI rents diverged most dramatically. This performance advantage persisted for approximately two years.

Sub-Sample Analysis: A Tale of Two Periods

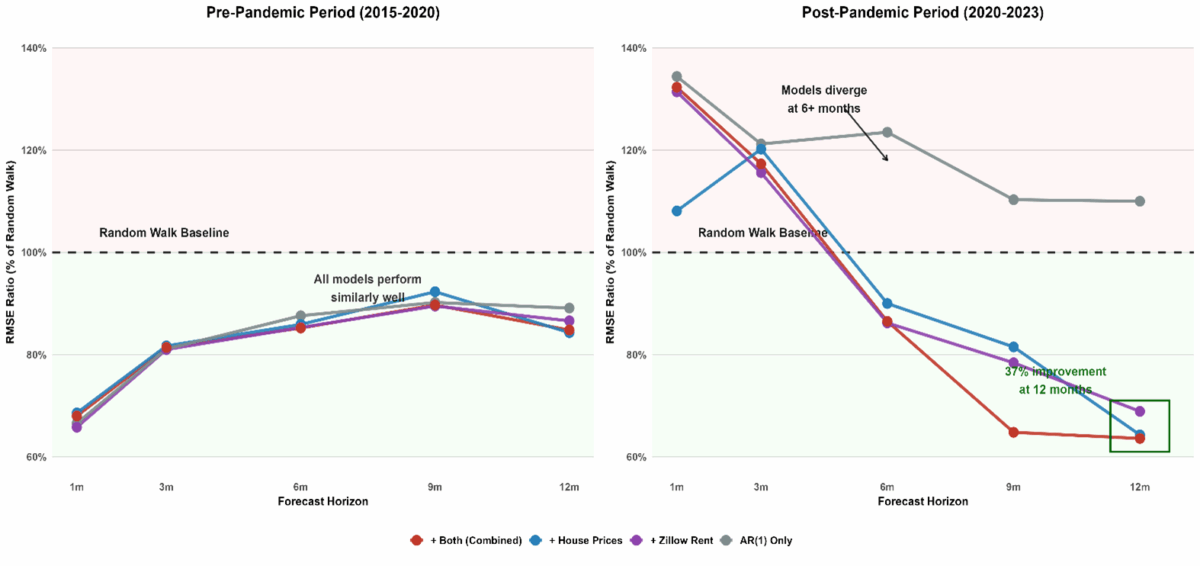

Motivated by the fluctuations test results, I split the sample into two periods, and the results are shown in the graph below.

Figure 4: RMSE ratios below 1.0 indicate better performance than random walk. Post-pandemic results show substantial improvements at 6–12 month horizons when including alternative data.

During the pre-pandemic period (2015-2020), Zillow data provided minimal forecasting improvements. Traditional models performed adequately.

During the pandemic, Zillow data provided information beyond what was available. 12-month ahead forecasts improved by 37% when including Zillow data and average 1–12 month forecasts improved by 33%. Combined models that included house prices and Zillow performed best overall.

Key Implications

The findings reveal when and how alternative rent indicators like ZORI can enhance inflation forecasting. These measures prove most valuable during periods of rapid market change, capturing real-time dynamics that official statistics miss due to their methodological design. However, this predictive power comes with important nuances.

The effectiveness of alternative data depends critically on the forecast horizon. While these indicators provide minimal value for near-term predictions of 1-3 months, they deliver substantial accuracy gains at 6-12 month horizons-precisely the timeframe most relevant for policy decisions.

Equally important, the usefulness of alternative indicators appears strongly tied to market conditions. The 30%+ forecast improvements observed during 2020-2022 emerged from extraordinary pandemic conditions that disrupted normal rental market patterns. In stable markets, traditional measures perform adequately, suggesting that alternative data’s exceptional predictive value is episodic rather than constant. Furthermore, models that combine multiple data sources-Zillow rent, house prices, and official statistics-consistently outperform any individual measure, highlighting how data diversity strengthens forecast reliability.

The practical takeaway is clear: forecasters should adapt their toolkit to market conditions. Rather than replacing official statistics with alternative data, the optimal approach involves monitoring multiple indicators and weighing them according to prevailing market dynamics. When markets shift rapidly-as they did during the pandemic-alternative measures like Zillow become essential early warning systems. When markets stabilize, their incremental value diminishes. This state-dependent approach to forecasting can help policymakers better anticipate inflation turning points while avoiding overreaction to market noise.

Note: This post is based on Kishor, N. K. (2024). Does the Zillow rent measure help predict CPI rent inflation?. Business Economics, 59(4), 220-226.

This post written by N. Kundan Kishor.