From Bloomberg:

“If we don’t adjust policy down, then I think that we do run risks,” Miran said during an interview with Bloomberg TV on Monday. Miran added he doesn’t foresee an economic downturn in the near term, though rising unemployment should push Fed officials to continue cutting rates.

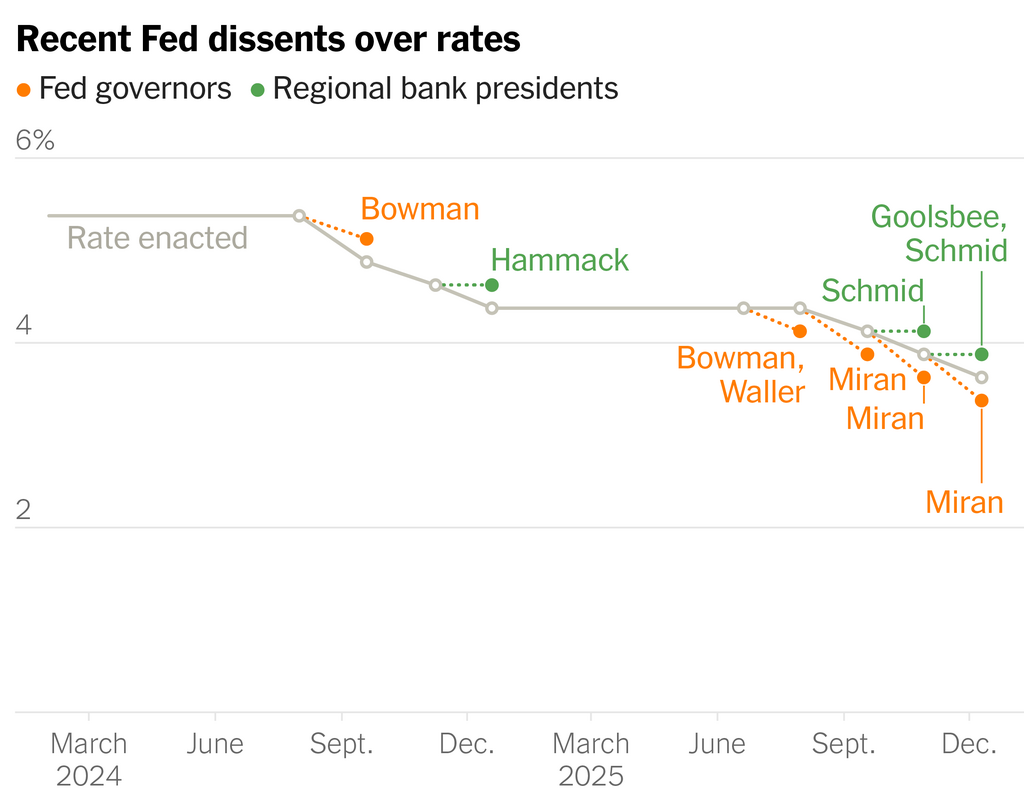

This graph from Andrew Ross Sorkin puts Miran’s view in perspective:

Source: Dealbook newsletter, 12/20/2025.

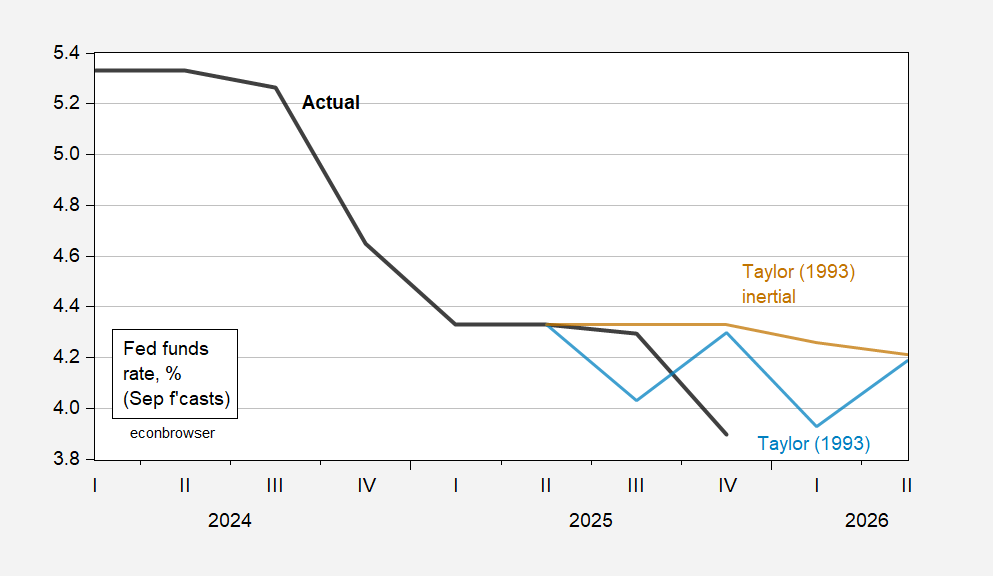

According to a simple Taylor rule (the original), the Fed funds rate is now below the implied.

Figure 1: Fed funds rate (bold black), Taylor (1993) implied rate (light blue), and Taylor (1993) implied inertial rule (tan), all in %. Source: Federal Reserve via FRED, and Cleveland Fed utility.

The prescribed Fed funds rate depends on r*; if Miran believes r* is 0.4 ppts lower than the median FOMC estimate as of September, 1%.