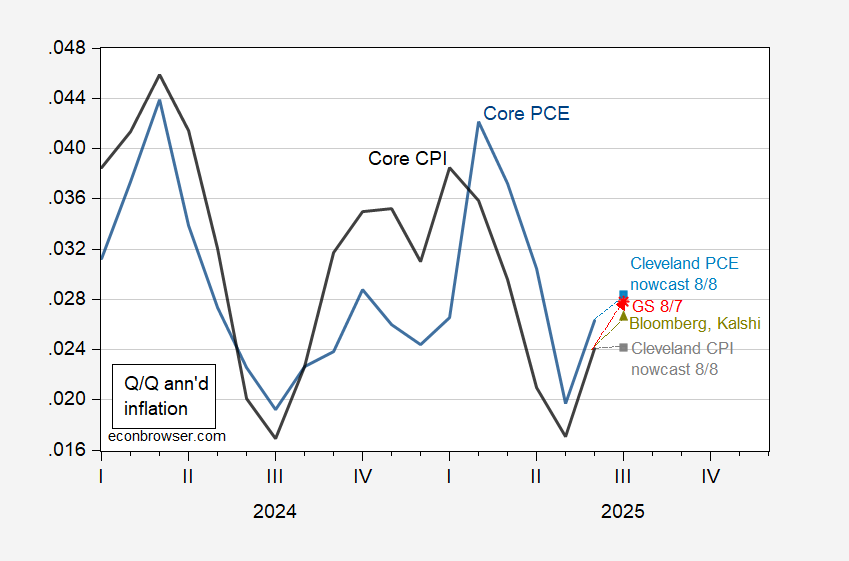

From Cleveland Fed, Goldman Sachs, plus Bloomberg consensus – generally, acceleration in the q/q annualized:

Figure 1: Quarter-on-Quarter annualized inflation of CPI (bold black), Cleveland Fed nowcast as of 8/8 (gray square), Bloomberg consensus, Kalshi betting CT (chartreuse triangle), Goldman Sachs as of 8/7 (red *), inflation of PCE (bold blue), Cleveland Fed nowcast as of 88 (light blue square). Source: BLS, BEA, Cleveland Fed accessed 8/8, Bloomberg, Kalshi accessed 8/8 noon CT, Goldman Sachs, and author’s calculations.

Note that the core CPI nowcasts from the Cleveland Fed do not rely on information such import prices, but rather past CPI only, while the core PCE relies on past CPI and PCE information, as discussed here. This stands in contrast to the headline CPI and PCE nowcasts which rely on additional information (e.g. gasoline prices). Hence, whether to put more faith on the nowcasts (restricted information but transparent), or tracking (presumably more information and more ad hoc, but less transparent) requires a tradeoff. The Cleveland Fed authors have at least documented how their methodology outperforms MIDAS and dynamic factor model approaches.