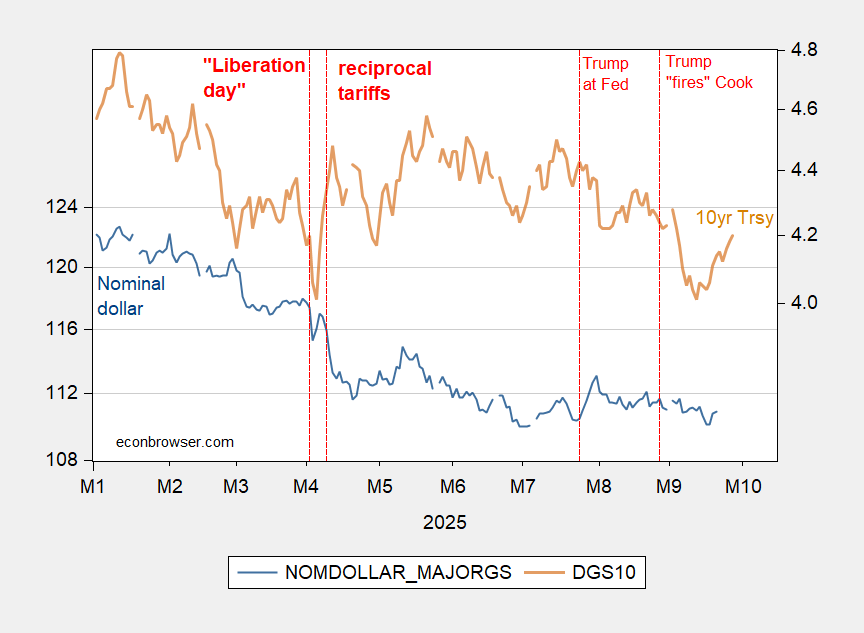

Some people argue the concurrent dollar decline and Treasury yield incrase was attributable to liquidity issues as repicing occurred against a backdrop of a rising share of price sensitive Treasury holders. Others that it was a flight away from the US dollar assets spurred by tariff uncertainty (see a discussion here). Here’s the picture people know, the dollar vs. US Treasurys:

Figure 1: Nominal dollar against advanced economies currencies (blue, left scale), and 10 year US Treasury yield, % (tan, right scale). Source: Federal Reserve, Treasury, via FRED.

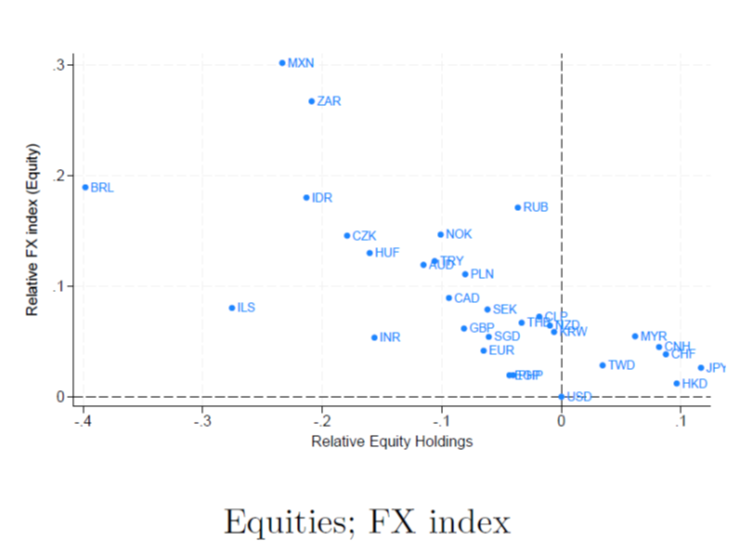

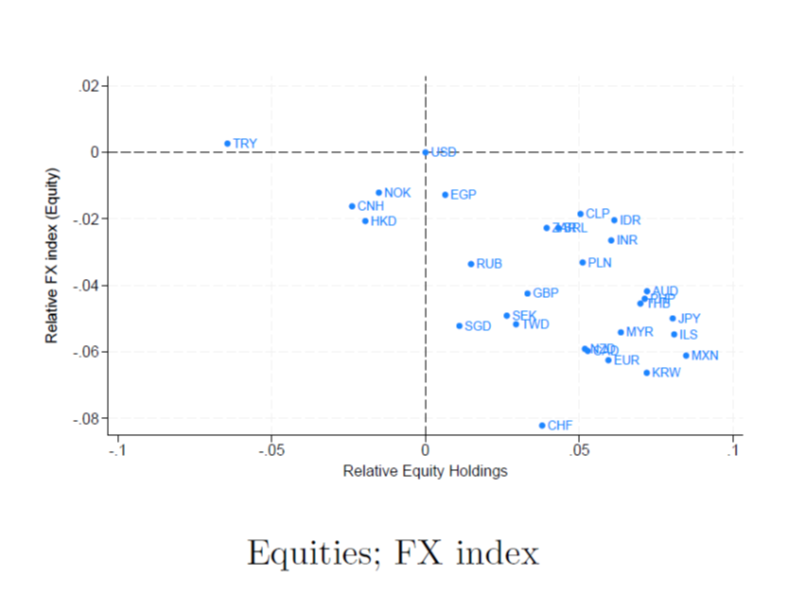

And here are two graphs from Helene Rey and Vania Stavrakeva, “Interpreting Turbulent Episodes in International Finance”keynote presented at the Asian Monetary Policy Forum (Singapore, 2025). (My discussion here).

The first is the reaction of the exchange rate to equity flows during the pandemic. The foreign currencies weakened as imputed equity flows moved to the US.

Source: Rey, Stravakeva (2025).

In contrast, in 2025 around “Liberation Day”, other currencies strengthened as imputed equity flows moved out of the US.

Source: Rey, Stravakeva (2025).

So, while I don’t discount completely the idea of illiquidity in the Treasury market as a driver of the increase in Treasury yields around “Liberation Day”, it seems to me that at least part of the shift post-“Liberation Day” is due to the decline in the confidence in the dollar. While the correlation in changes in the dollar’s vale and in the Treasury yield have re-asserted itself, it’s interesting that in Figure 1, the gap that widened in the levels has persisted.